Welcome to the 3 Money Amigos podcast! Join Brent, Joye, and Beverly as they talk about the child tax credit. In recent years, regulations under the child tax credit have changed a lot. But as of 2021, taxpayers with children from ages 16 and below can qualify for this credit and earn up to $2000. Today, the three share their experiences with the child tax credit and their concerns about its qualifications. And whether or not you have kids, there’s still plenty to take away from this episode so, stay tuned and enjoy the show!

Here’s what to look forward to on today’s episode:

- The evolution of the child tax credit and its impact on minorities through the years.

- Why we need government representatives who have the minorities’ best interest in mind.

- The difference between stimulus checks and advanced child tax credit payments.

- Using the IRS portal to manage our tax credit payments according to our current income.

- Where to invest your advanced payments to get an increased rate of return over time.

- And much more!

~

Connect with the 3 Money Amigos!

Website: www.3moneyamigos.com

3 Money Amigos

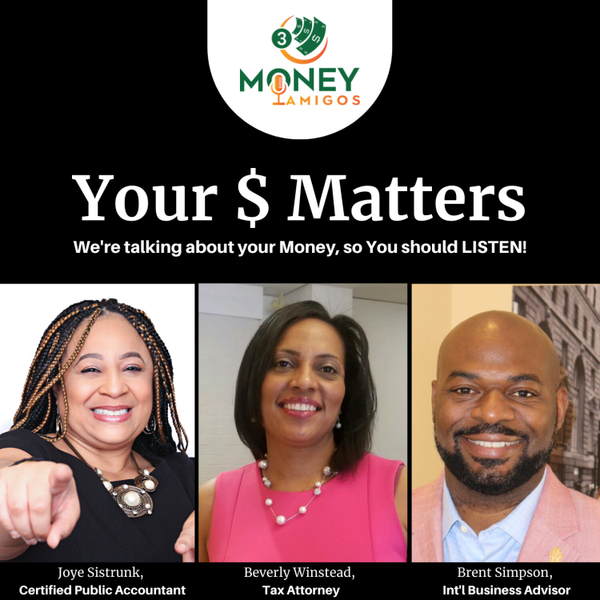

Your $ Matters

We're talking about your Money, so You should LISTEN!

Joye Smith Sistrunk is currently the Principal/Founder of Premier Group Services (PGSI), a Certified Public Accounting and Management Consulting firm. Always having a passion for problem solving and a desire to help others, Joye decided at a very early age that she wished to be Certified Public Accountant.

Brent is the founder of Bold Vision Enterprise, Bold Vision MasterMinds, Bold Vision Podcast, Co-Founder of Linked Leaders Academy, Investing Education Academy , Black Podcasters Power Network. He brings innovative business and planning process experience to his clients and their companies. With a keen eye for corporate innovation and strategic positioning Brent’s business advising serves early entrepreneurs and seasoned business owners alike. He has 17 years of licensed financial consulting experience under his belt. For 9 years of his corporate career, he served as Chief Operations Officer of a small startup company in Washington, DC. Before leaving, Brent helped grow the company’s annual revenue from $150,000 to $14,600,000. His diverse pool of professional experiences gives Brent a unique understanding of technical and practical business needs and solutions.

Attorney Beverly L. Winstead is the founder and managing member of the tax law firm Law Office of Beverly Winstead, LLC, specializing in tax resolution, estate planning and sports and entertainment law. In 2018, she was honored as one of the National Bar Association’s Top “40 Under 40” lawyers in the country. That same year, she made history as the 1st Person of Color to Chair the Maryland State Bar Association’s Tax Section.